- About

- Programs

- After School Classes

- All-School Assemblies

- The BE KIND Business

- The BE KIND Community Education Center

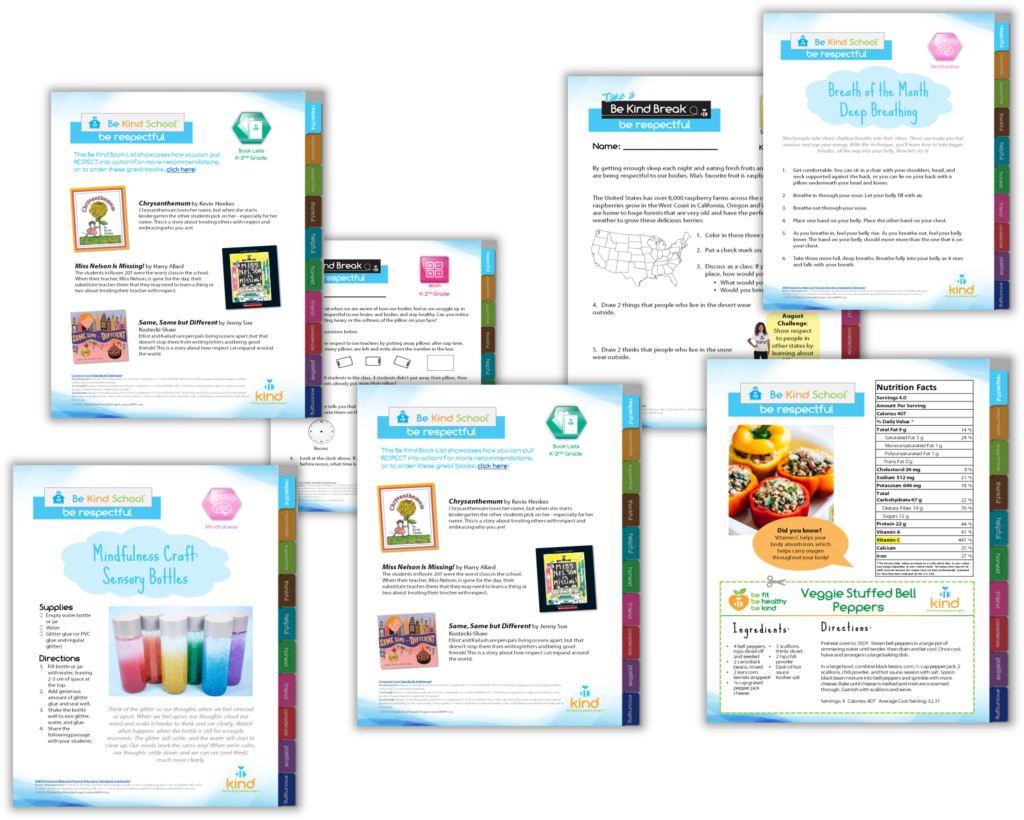

- The BE KIND SCHOOL

- BE KIND on the MOVE

- Classroom Resources

- #CyberSkills

- Family Engagement

- Fitness Programs

- Gardens

- Grace’s Group

- Health & Wellness

- Summer Programs

- Teacher Training

- Wellness Wednesday

- Athletes for Arizona

- Events

- Get Involved

- Donate

Arizona State Tax Credit

- Home

- Tax Credit Donation

Make a Tax Credit Donation

Support a Generation of Kind and Respectful Youth

Replace your state taxes with a gift to initiate positive change for students through The Be Kind People Project tax credit. With children facing greater social, academic, and mental health challenges, the need for effective, high-impact youth development is more important than ever.

BKPP’s evidence-based solutions:

- improve academic achievement

- foster social and relationship skills

- support overall mental and emotional well-being

- offer proactive solutions to bullying and cyberbullying

- establish personal responsibility

The Impact of Your Donation

$421

supports 53 students for a year

$841

supports 4 BE KIND Classrooms for a year

$5500

$5500 supports 1 BE KIND School for a year

How It Works

The tax credit is under the Charitable Organization category and will replace what you owe in state taxes by $841 for married couples or $421 for single filers. Please check with a tax professional. Visit https://azdor.gov/tax-credits/contributions-qcos-and-qfcos for more information.

The Be Kind People Project is a 501(c)3 Qualified Charitable Organization, and as such, your contributions are eligible for the maximum charitable tax advantages available by law.

The Impact of Kindness

Behavior referrals reduce by an average of 19% in the first year and 47% in the third year of BE KIND programming.

On average schools achieve an 11% academic improvement after implementing The Be Kind School classroom resources for 1 year.

On average, teachers were 97% likely to implement The Be Kind Pledge in their classrooms.

After BE KIND programs, 94% of students surveyed were able to identify and apply healthy habits.

After a #CyberSkills program, 97% of students commit to showing kindness online.

Learn More about BKPP

Learn More about The Be Kind People Project®

- Programs

- After School Classes

- All-School Assemblies

- The BE KIND Academy

- The BE KIND Business

- The Be Kind Break

- The BE KIND School

- The BE KIND on the MOVE

- #CyberSkills

- Family Engagement

- Fitness Programs

- Gardens

- Grace’s Group

- Health & Wellness

- Summer Programs

- Teacher Training

- Wellness Wednesday

- Athletes for Arizona

Copyright © The Be Kind People Project | Privacy Policy