- About

- Programs

- After School Classes

- All-School Assemblies

- The BE KIND Business

- The BE KIND Community Education Center

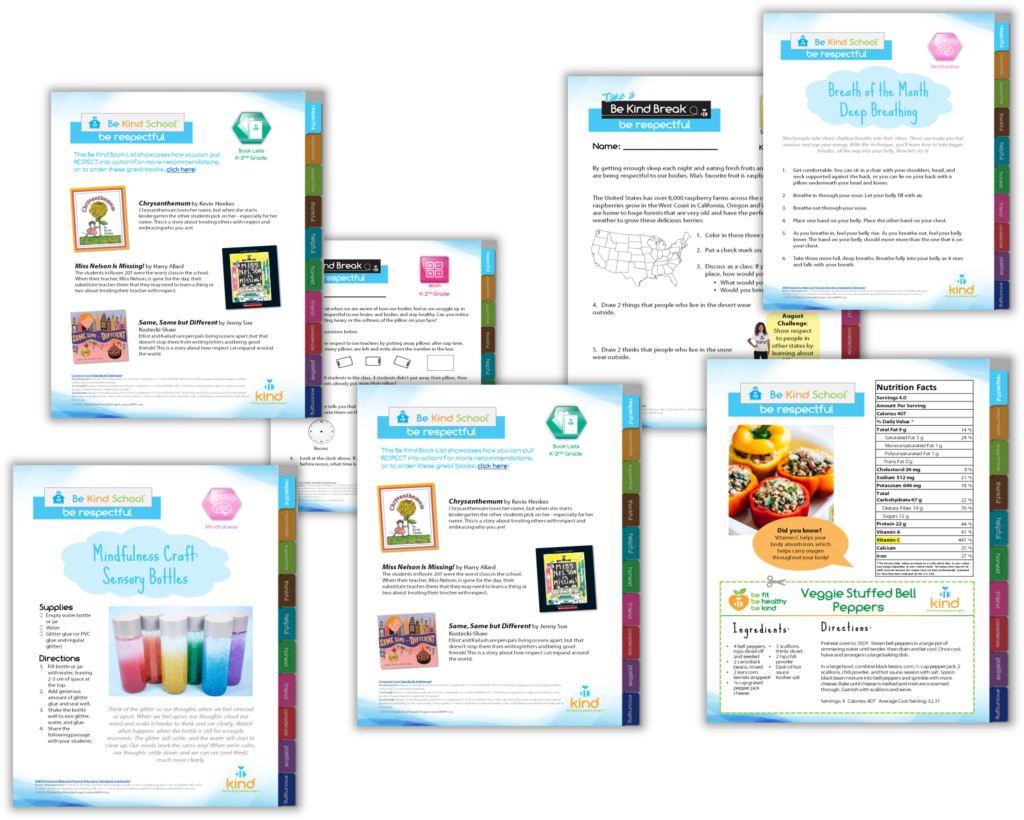

- The BE KIND SCHOOL

- BE KIND on the MOVE

- Classroom Resources

- #CyberSkills

- Family Engagement

- Fitness Programs

- Gardens

- Grace’s Group

- Health & Wellness

- Summer Programs

- Teacher Training

- Wellness Wednesday

- Athletes for Arizona

- Events

- Get Involved

- Donate

The Price of Happiness

- Home

- Wellness Wednesday

- Emotional Wellness

- The Price of Happiness

Finding Financial Balance for a Thriving Social Life

The Impact on Social, Mental, and Emotional Wellbeing

The Value of Friendship

We all know that money matters, but its impact on our health is often underestimated. We’re tackling a topic that is the #1 stressor in the United States: money. According to a national survey conducted by Discover and Thriving Global, “Financial well-being is a critical component of holistic well-being. Yet for most Americans, finances remain a primary source of frustration, anxiety, and stress. In fact, years of research continue to identify money as the top stressor in the United States, with 90% of individuals saying that money has an impact on their stress levels.”

The study found that finances impact mental health, physical health, mood, work satisfaction, sleep, and relationships. Let’s explore some practical tips for budgeting, saving, and finding affordable ways to maintain an active social life without breaking the bank.

How are your finances impacting your social, mental, and emotional well-being?

Let’s take a look at the checklist.

Am I Getting Closer to Financial Freedom?

- If yes, GREAT…Keep up the excellent work!

- Wait, what is financial freedom again?

- This means living without debt or having no trouble making payments! Find your Financial Health score with Nerd Wallet!

- Start by creating a realistic budget that aligns with your income and goals. Track your expenses and allocate funds for essentials, savings, and leisure activities. A budget provides clarity, empowers you to make informed financial decisions, and reduces stress.

Am I on Pace to Reach My Goals?

- If yes… WOOHOO!

- I’m not so sure.

- Prioritize Saving: Make saving a priority in your budget. Financial experts recommend setting aside some of your income for emergencies, future goals, and unexpected expenses. Having a financial safety net brings peace of mind and reduces anxiety about the unknown.

Have I Paid Off All My Loans?

- Way to go!!

- Maybe later…

- Reduce Debt: Develop a strategy to tackle and reduce your debt. Prioritize high-interest debts and consider debt consolidation or refinancing options. As you pay off debt, you’ll experience a sense of financial freedom, which positively impacts your mental well-being.

Have I Regretted a Recent Purchase?

- No! You earned it.

- I did not budget for that…

- Practice Mindful Spending: Before making purchases, ask yourself if they align with your needs and values. Practice mindful spending by avoiding impulse purchases and evaluating whether an item or experience truly contributes to your well-being and happiness.

Am I Happy With My Job? / Is There a Way to Increase My Income?

- Yes! But I need a change.

- Is there really a way out?

- Seek Financial Education: Expand your financial knowledge by reading books, attending workshops, or consulting with a financial advisor. Understanding personal finance concepts equips you with the tools to make informed decisions and take control of your financial future.

Do I Have Support?

- Absolutely!

- No one knows about my current situation…

- Cultivate a Supportive Social Network: Surround yourself with individuals who share similar financial values and emotional goals. Supportive friends can provide motivation, accountability, and practical tips for improving overall wellness. If you’re not sure where to start, meet with an expert.

Do I Make Time For Myself every day?

- Of course, I do! Treat Yourself!

- What time???

- Practice Self-Care: Harvard Business Journal emphasizes engaging in self-care activities that especially don’t require a significant financial investment. Take time to relax, exercise, spend quality time with loved ones, and pursue hobbies that bring you joy whether this is at home or during a break at work. These activities enhance your mental well-being without straining your finances.

Remember, finding harmony between your financial health and social life is key to maintaining a positive mindset and reducing stress. Thriving Wallet survey concludes, “better financial well-being is significantly and positively related to better physical health, mood, satisfaction with work, household activities, social relationships, family relationships, leisure time activities, ability to function in daily life, economic status, living/housing situations, overall well-being, and far, far more.” By setting realistic budgets, using helpful cost calculators, and seeking out affordable social activities, you can strike that perfect balance that promotes both financial stability and a vibrant social life.

Published on May 23, 2023

Questions? Comments? Want to contribute to the Wellness Wednesday Blog?

Send your ideas to info@bkpp.org.

Learn More about The Be Kind People Project®

- Programs

- After School Classes

- All-School Assemblies

- The BE KIND Academy

- The BE KIND Business

- The Be Kind Break

- The BE KIND School

- The BE KIND on the MOVE

- #CyberSkills

- Family Engagement

- Fitness Programs

- Gardens

- Grace’s Group

- Health & Wellness

- Summer Programs

- Teacher Training

- Wellness Wednesday

- Athletes for Arizona

Copyright © The Be Kind People Project | Privacy Policy